|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

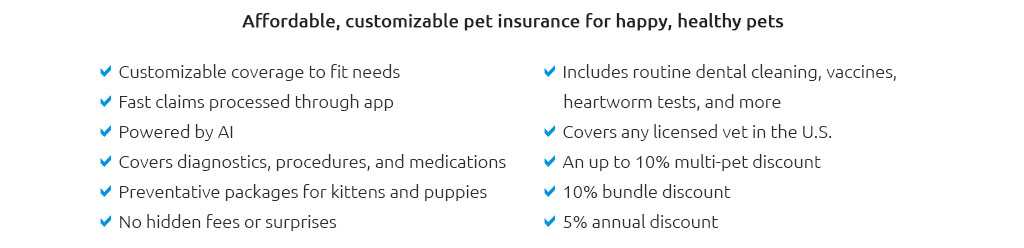

Exploring Cheap Pet Health Insurance for Dogs: A Comprehensive GuideWhy Consider Pet Health Insurance?Pet health insurance can be a lifesaver, both for your dog's wellbeing and your wallet. It helps cover unexpected veterinary costs, ensuring your furry friend receives the best care without financial strain. For those interested in a thorough comparison, you can compare pet insurances for dogs to find the best fit. Benefits of Cheap Pet Health InsuranceOpting for affordable insurance doesn't mean compromising on care. Here are some advantages:

Potential Drawbacks to ConsiderWhile cheap pet insurance has its perks, there are also potential downsides:

How to Choose the Right PlanAssess Your Dog's NeedsEvaluate your dog's breed, age, and existing health conditions. Breeds prone to specific health issues might require more comprehensive coverage. Compare Plans and ProvidersWhen selecting a policy, it's crucial to consider factors like the cost of pet insurance for a cat if you have multiple pets, as discounts might apply. FAQ

https://www.progressive.com/pet-insurance/

Accidental injuries. Pets Best offers an affordable, fixed-price pet insurance plan for broken bones, bite wounds, accidental swallowing of foreign objects, and ... https://mobile.usaa.com/insurance/additional/pet

Pet health insurance is administered by Embrace Pet Insurance Agency ... https://www.petinsurance.com/dog-insurance/

Our puppy and adult dog insurance plans cover accidents, illnesses, and wellness. No matter your needs, you can choose the best coverage for you and your dog.

|